When you send BTC to someone, you must pay a fee for each corresponding transaction. The fees incentivize the miners to validate the transactions and add them to the subsequent block on the Bitcoin network.

Bitcoin transaction fees prevent spam transactions that can lead to network congestion and slow down operations. Since the fees are dynamic and change according to market demands, you have to adjust them for each transaction.

A Bitcoin fee estimation process will prevent you from overpaying or underpaying fees for a particular BTC transaction. In this article, we’ll explain what is Bitcoin fee estimation, how it works, BTC fee estimation tools, and how you can use them.

What Is Bitcoin Fee Estimation?

BTC transaction senders must determine a fee they’re willing to pay to include their transaction in a new block. A higher fee means a greater probability of a faster confirmation while a lower fee may lead to delayed confirmation times.

Miners mine a new block every ten minutes and choose which transactions to include depending on the transaction fees. A greater fee will encourage miners to pick it up earlier compared to other transactions with lower fees.

Bitcoin transaction fees don’t depend on the BTC amount you’re sending but on the transaction size and block space demand. Since each Bitcoin block can store 4 MB of data, transactions with larger sizes require higher fees.

For example, a Bitcoin Ordinal transaction worth $500 may cost more compared to a BTC transfer worth $1000 because the former has a larger transaction size.

Types of Bitcoin Fee Estimation Methods

When you send BTC, the wallet shows an option to select a fee rate. The fee rate is the satoshis (smallest BTC unit) you’d pay for every byte of the transaction represented in sats/vByte or satoshis per virtual byte.

There are two ways to determine the fee rate for a Bitcoin transaction.

Mempool-based estimation

You can analyze the Bitcoin mempool, the memory pool containing unconfirmed BTC transactions, from which miners select and add transactions to Bitcoin blocks. The mempool provides a real-time fee rate overview of recent pending transactions to understand the existing fee landscape.

A mempool estimation is responsive to short-term market changes and provides accurate suggestions based on updated data from the mempool’s contents. This method is useful if you want rapid transaction confirmation from miners in the next few blocks.

For example, Mempool space provides a visually rich and graphical representation of Bitcoin’s fee rates.

History-based estimation

You can use historical transaction data to predict an estimated fee trend for future transactions. This method analyzes old data to identify patterns, fee movements, and fluctuations over time to provide a stable fee estimation.

A historical estimation is suitable for flexible confirmation times when users are not in a hurry for immediate transaction confirmation.

For example, Bitcoin Core uses a history-based fee estimation technique where it groups transactions into similar fee rate buckets. It tracks the confirmation time over different periods applying a decay factor for each dataset and success thresholds.

How Does Bitcoin Fee Estimation Work?

Some crypto wallets and Bitcoin fee estimation tools use real-time data from the Bitcoin network to suggest transaction fees. They analyze the blockchain’s current state and predict a fee you’ve to pay to confirm the transaction within a specific timeframe.

Bitcoin fee estimators offer a seamless way to calculate transaction fees in the following manner:

Data Collation- Fee calculators collect data from the Bitcoin mempool and the latest mined blocks to get an overview of pending transactions and existing fee dynamics.

Data Analysis- Calculators analyze the data to understand block space demand and total unconfirmed transactions to determine the fee structure.

Fee Estimation- The tools use the collected data to recommend a fee for different confirmation times (fast-10 minutes, medium-30 minutes, slow-1 hour) depending on network congestion.

Real-time Updates- These tools constantly update the fee rate depending on mempool data and the latest network status to provide an accurate fee estimation.

How To Calculate Optimal Bitcoin Transaction Fees

You can calculate Bitcoin transaction fees by estimating the transaction size and fee rate and multiplying them.

Estimate the transaction size

A typical Bitcoin transaction consists of inputs and outputs. Inputs refer to past BTC transactions you received and outputs refer to the addresses you’re sending BTC to.

For example, you have 1 BTC in your wallet which is comprised of multiple small inputs of 0.1 BTC. If you send 1 BTC to someone, the transaction will contain all your input transactions.

The transaction size is the sum of inputs, outputs, and an additional fixed overhead size of each transaction.

Choose fee rate

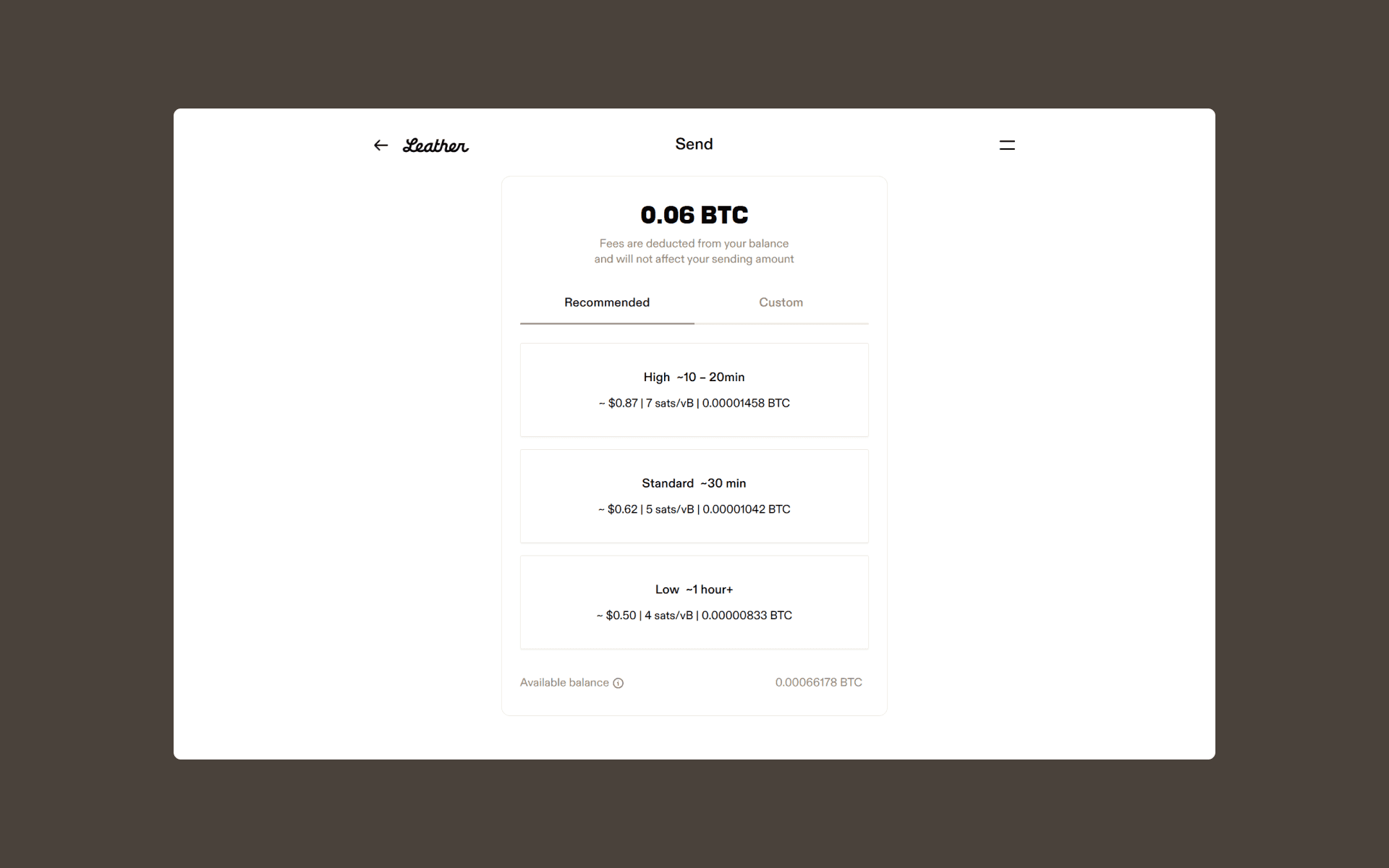

The fee rate fluctuates according to block space demand, network congestion, and unconfirmed transactions in the mempool. You can find the recent average fee rate for different time spans from Bitcoin fee estimators or wallets like Leather give estimates based on an average across various networks.

Calculate transaction fees

Finally, you have to multiply the transaction size in bytes by the fee rate to get the Bitcoin transaction fees in sats/vByte.

For example, each transaction input is about 148 bytes, output is 34 bytes, and overhead size is 10 bytes. If we have 2 inputs and outputs for a transaction, then the total transaction size is 374 bytes. To break it down:

Input: 2*148=296 bytes

Output: 2*34=68 bytes

Overhead: 10 bytes

Total size: 374 bytes (296+68+10)

If the average fee rate is 50 satoshis per byte, the total transaction fee is 18,700 satoshis (374 bytes*50 satoshis) or $12.69.

How To Optimize Bitcoin Transaction Fees

You can take fee suggestions from calculators and wallets but further optimize your Bitcoin transaction fees by following the steps below:

Choose the correct time- You should try to choose a time when the Bitcoin network is not busy for cheaper and faster transaction settlements.

Verify the mempool- You must always verify the Bitcoin mempool to understand pending transactions status and average fees before manually choosing your fee rate.

Reduce transaction size- Since fees depend on the transaction size, you can reduce sizes by grouping transaction inputs and using SegWit Bitcoin addresses.

Top 3 Bitcoin Fee Estimation Tools

Bitcoin fee estimation tools help you calculate an average fee for a BTC transaction according to existing network conditions. Some of the popular fee estimators are:

Bitcoiner.live

Bitcoiner.live estimator is a website that provides real-time data to help Bitcoin users calculate optimal fees for their transactions. Users can choose from multiple confirmation targets to balance transaction speed and costs according to their needs.

The tool provides an intuitive user-friendly interface, historical data access, easy visualization, and API integration for third-party applications. Bitcoiner.live is suitable for first-timers, frequent BTC users, merchants, traders, crypto companies, and developers.

BitcoinFees

The BitcoinFees estimator tool provides transaction fee estimations for different time targets. The estimator analyzes the Bitcoin network’s current state and previous states to provide a fee estimation.

BitcoinFees displays a chart for advanced users to graphically represent the mempool to see network load and avoid peak times. Moreover, users can avail of the transaction accelerator to push forward a stuck transaction with a lower fee.

BTC Network Fee Estimator

The BTC Network fee calculator tool has a simple user interface to calculate the optimal fees for Bitcoin transactions. It provides an estimated fee with a sliding bar to adjust the time frame and number of blocks.

Users can further enter inputs and outputs to calculate the total transaction size in bytes and estimate fee rates in sats/vByte. The tool also shows the time since the last block, the mempool size, unconfirmed transactions, and a 7-day fee comparison with average fees.

How Crypto Wallets Estimate Bitcoin Transaction Fees

Some crypto wallets automatically calculate the transaction fee and you can go with it, depending on your urgency. However, other wallets don’t let you choose a fee because of their default fee-setting structure, leading to overpaying for transactions.

Bitcoin wallets like Leather simplify BTC transaction fees by automatically determining an optimal fee depending on the network status. Moreover, users have the choice to manually adjust the fee by increasing or decreasing it, depending on their confirmation immediacy.

Therefore, you can either directly use Leather to opt for its automatic fee calculation or use an estimator tool to manually set the fees. This provides more flexibility and efficiency, empowering you to make decisions based on your requirements without overpaying or underpaying for your transactions.