Help Center

What are BRC-20 Tokens?

Jun 9, 2025

This information is for educational purposes only and should not be considered financial advice.

BRC-20 tokens are a token standard for minting and transferring fungible tokens on the Bitcoin network. A pseudonymous programmer called Domo introduced BRC-20 as an experimental token standard and used Casey Rodarmor’s Ordinals protocol to create fungible tokens.

What is BRC-20 and How Did it Start?

BRC-20 is an experimental token standard that enables the creation of fungible tokens on the Bitcoin blockchain. The BRC-20 token standard was created in March 2023 by the pseudonymous programmer Domo and leverages the Ordinals protocol to mint and transfer tokens.

The Ordinals protocol facilitates attaching extra data to the smallest Bitcoin units or satoshis (sats), known as inscription. BRC-20 tokens use the Ordinals inscriptions to inscribe data on satoshis in human-readable and machine-parsable JSON (JavaScript Object Notation) format. The JSON data format contains the BRC-20 token’s details like total token supply, minting limit, and ticker.

The BRC-20 token standard enables users to issue, transfer, and manage fungible assets directly on Bitcoin, thereby expanding the network’s utility. Users have minted several memecoins on Bitcoin using the BRC-20 token standard and the first fungible token created on Bitcoin is called ORDI.

What Are BRC-20 Tokens Used For?

- Token transfers: BRC-20 tokens are primarily used for minting and transferring them to each other. Users can buy BRC-20 tokens from marketplaces and trade them on exchanges. These tokens are ideal for peer-to-peer (P2P) transfers within the secure Bitcoin ecosystem.

- **Bitcoin finance: **Although BRC-20 tokens are still in its nascent stages, they have the potential to be deployed in Bitcoin DeFi protocols. Thus, BRC-20 based fungible tokens can be used in decentralized lending-borrowing platforms, automated market makers, and for yield farming opportunities. Moreover, BRC-20 tokens can be used for tokenizing real-world assets which’ll enable fractional ownership and trading of these assets on Bitcoin.

Pros and Cons of BRC-20 Tokens

Advantages of the BRC-20 token standard:

- Bitcoin network compatibility: BRC-20 tokens are integrated with the Bitcoin network and supported by the blockchain’s robust backend architecture. Moreover, the tokens are compatible with existing Bitcoin wallets and supporting exchanges, making them easily available to the vast Bitcoin community.

- Easy to use: The BRC-20 token standard follows a simple tokenization system that doesn’t rely on complicated smart contracts. Thus, users can easily mint and send BRC-20 tokens without requiring prior technical knowledge.

- Highly secure: BRC-20 tokens inherit Bitcoin blockchain’s security, making them safe for all. The underlying network’s Proof-of-Work (PoW) consensus mechanism and decentralized infrastructure protects BRC-20 tokens against online attacks.

Disadvantages of the BRC-20 token standard:

- Lack of smart contract support: BRC-20 tokens don’t use smart contracts and have limited scope in its programmability. Thus, their utilities are restricted to minting and token transfers since BRC-20 tokens cannot be configured for other use cases.

- Limited scalability: Since BRC-20 tokens run on the Bitcoin blockchain, they inherit the same problems of Bitcoin like slow transaction speeds and high fees. A spike in transaction load leads to network congestion with delayed transaction confirmation times.

- Lack of interoperable features: The BRC-20 token standard is only functional within the Bitcoin network ecosystem, thereby preventing cross-chain deployability and token transfers. So, users on different blockchains cannot use BRC-20 tokens.

How to Buy BRC-20 Tokens

You need a Bitcoin Taproot wallet like Leather to buy BRC-20 tokens. There are multiple marketplaces and exchanges like UniSat, Ordinals Wallet, Gate.io, KuCoin and others to buy BRC-20 tokens. You can also choose to mint, send, and receive BRC-20 tokens with your Leather.

Follow the steps below to buy BRC-20 tokens from marketplaces with Leather:

Step 1: Connect your Leather by clicking on the ‘Connect Wallet’ button.

Step 2: Browse through the BRC-20 token collection and select your token.

Step 3: Click the ‘Buy’ button for the BRC-20 token you want to purchase.

Step 4: Select the fee option (Low/Medium/High) for your transaction and click ‘Continue’.

Upon successful purchase, the BRC-20 tokens will appear in the ‘Collectibles’ section of your Leather.

If you want to buy BRC-20 tokens from an exchange, you’ll have to deposit the transfer inscription associated with your purchased BRC-20 token into your Leather. To do so, follow the steps below:

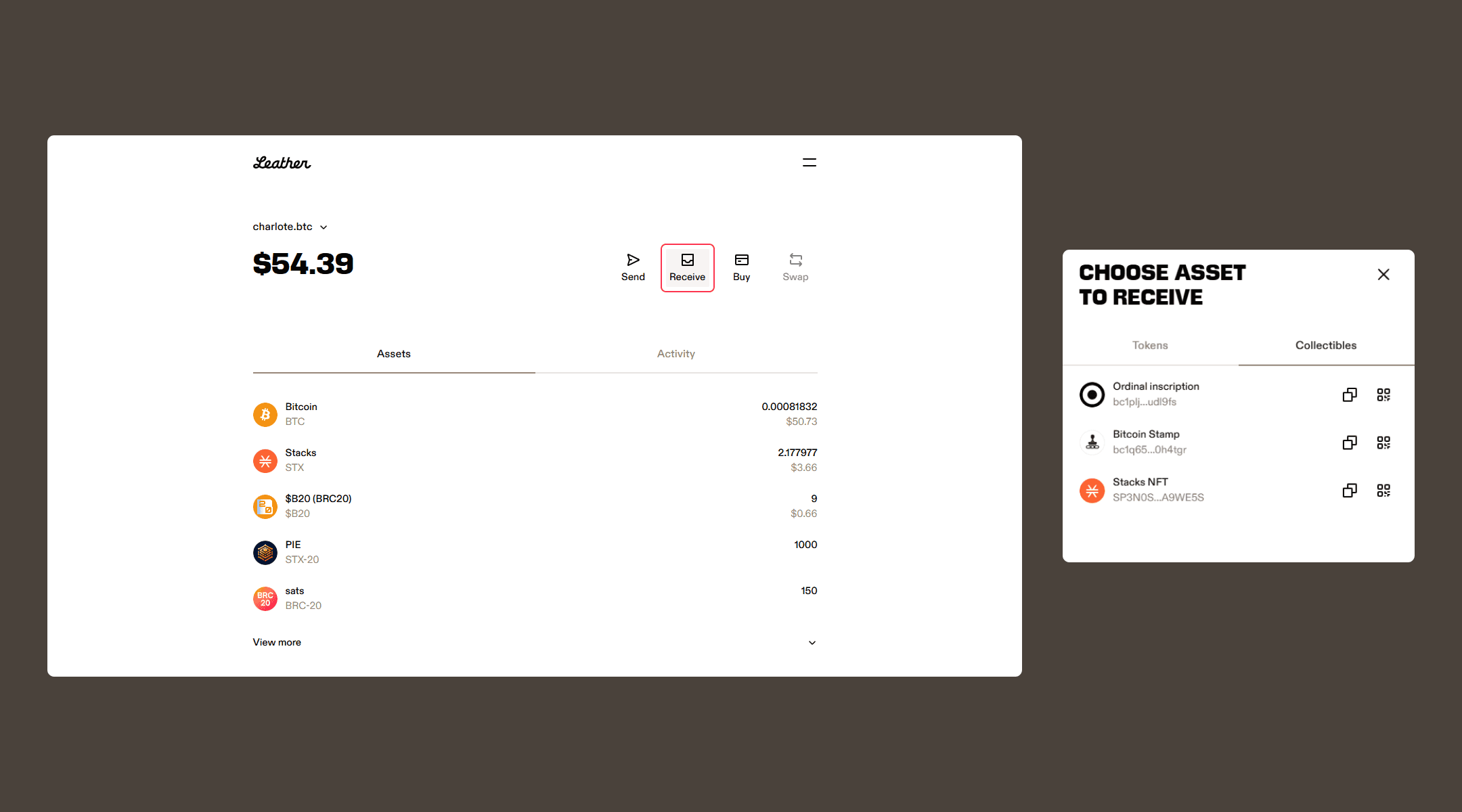

Step 1: Click on ‘Receive’ in the Leather wallet extension page.

Step 2: Copy the Taproot address associated with your account.

Step 3: Enter the copied address in the recipient section when you’re sending the transfer inscription from the exchange.

Future of BRC-20 Tokens

The BRC-20 token standard is still in its experimental stages. However, the total market cap of BRC-20 tokens have crossed $1.5 billion, according to Coingecko. Thus, BRC-20 tokens have the potential to become one of the leading digital asset categories in the coming days.

BRC-20 tokens have the advantage of a strong Bitcoin community supporting their growth. If these tokens diversify their utility and leverage Bitcoin Layer-2s to avoid network congestion on the main chain, BRC-20 tokens have a bright future ahead.