Help Center

Can Bitcoin Be Used for Remittances?

Jun 12, 2025

Leather does not control the stability or value of cryptocurrencies used for remittances. Users are responsible for understanding the risks and implications of using Bitcoin for international money transfers.

Bitcoin can be used for remittances by transferring cryptocurrency to others’ wallets. This allows people to quickly and securely send money around the world.

However, Bitcoin is very expensive to send because of the high gas fees, and the slow times for transaction validation do not make it the ideal channel for remittances. But given the number of days it can take to send remittances through traditional banking and fintech channels, bitcoin may still be a better option from a cost and time perspective.

The Remittance Industry Explained

Remittances are payments a person sends to their family or friends abroad. Typically, this takes the form of someone who has moved to a country with higher earning potential and is sending money back to people in their home country.

These payments are made through a bank or electronic money transfer service, which takes a fee from the total amount sent. Remittances are common in developing countries, where they can play a huge role in local economies.

What is Bitcoin Remittance?

Bitcoin remittance is a peer-to-peer payment made by sending Bitcoin from one individual to another. A person can transfer crypto from their own wallet to anywhere in the world via the recipient’s unique Bitcoin address. While the outcome is similar to a traditional fiat remittance, using Bitcoin to send money abroad cuts out the middle-man.

How Bitcoin Can Be Used for Remittances

Bitcoin remittances are secure, peer-to-peer transactions. Eliminating the need for a third-party institution (such as Western Union) allows people to send money at any time, with the funds received almost instantly. This is in contrast to traditional payments, which can take from one day to several weeks to clear, depending on the origin and destination countries.

Sending bitcoin also means avoiding fees associated with currency conversion. Because the amount sent and amount received are both in BTC, there are no additional delays or costs associated with switching between fiat currencies.

How to Transfer Money to Another Country With Crypto

Using bitcoin to transfer money internationally is done the same way as domestic bitcoin transfers. Because crypto transfers don’t require banks, intermediaries or specific software providers, all you’ll need is a wallet that allows you to transfer assets, and the Bitcoin address for the recipient.

According to Bitso, a cryptocurrency exchange with official presence in Argentina, Brazil, Colombia, and Mexico, “even though in México retail users of the platform still purchase Bitcoin more frequently than stablecoins, the use of stablecoins for remittances is gaining importance and traction amongst money transfer companies. These companies are turning to stablecoins for cost-effective and fast cross-border payments, taking advantage of regulated providers like Bitso.”

There are many companies building stablecoin infrastructure on Bitcoin layer 2s, such as Bima Money, Hermetica, Yala, and Ducat.

Why Crypto Remittance is Helpful

Compared to traditional remittance options, crypto-powered remittances are fast and cheap. Reducing the reliance on third-parties plays a huge part in improving accessibility for the underbanked, as well as circumventing banking issues that can arise in countries undergoing political turmoil.

Consider Venezuela, where “about 30% of Venezuelan households” receive remittances, according to Bloomberg. High transaction fees for traditional remittances, fiat currency volatility and local government restrictions that result in three-day transaction settlements have created a challenging situation for those in the country who rely on remittances.

Crypto remittances avert these issues. Bitcoin remittance transactions are fast, allowing people to access the remittance sooner. And because there is no intervention from electronic transfer institutions, the percentage of the transaction that gets taken for fees can be very inexpensive.

Cons About Bitcoin Remittances

Some cons to Bitcoin remittances include lack of everyday opportunities to make purchases with crypto, volatility in the marketplace and varying regulations.

Increasingly, there are options for people who want to make purchases with crypto, but those options are not ubiquitous. For people in developing countries, it may be necessary to convert a crypto remittance back to fiat in order to use it. This adds a layer on the backend of the process. There are also regulatory concerns to consider. While most countries permit the use of Bitcoin, if a recipient lives in one of the areas where cryptocurrency is banned, this could cause some issues.

Stability can also be an issue for some. As far as cryptocurrencies go, Bitcoin is a relatively stable asset. But there are other options. Companies like Felix Pago, which delivers remittances in Latin America, didn’t want to expose their clients to the volatility risks of crypto, so they turned to stablecoins like USDC. They liked the fact that it was backed by U.S. assets custodied in regulated U.S. financial institutions that were regularly audited.

The stablecoin market is witnessing a period of tremendous growth. According to a recent report from Castle Island Ventures, “there are over $160 billion worth of stablecoins in circulation today, up from single digit billions as recently as 2020.”

Transfer Money to Another Country With Leather

Transferring money with your Leather wallet is the same process for international and domestic transfers.

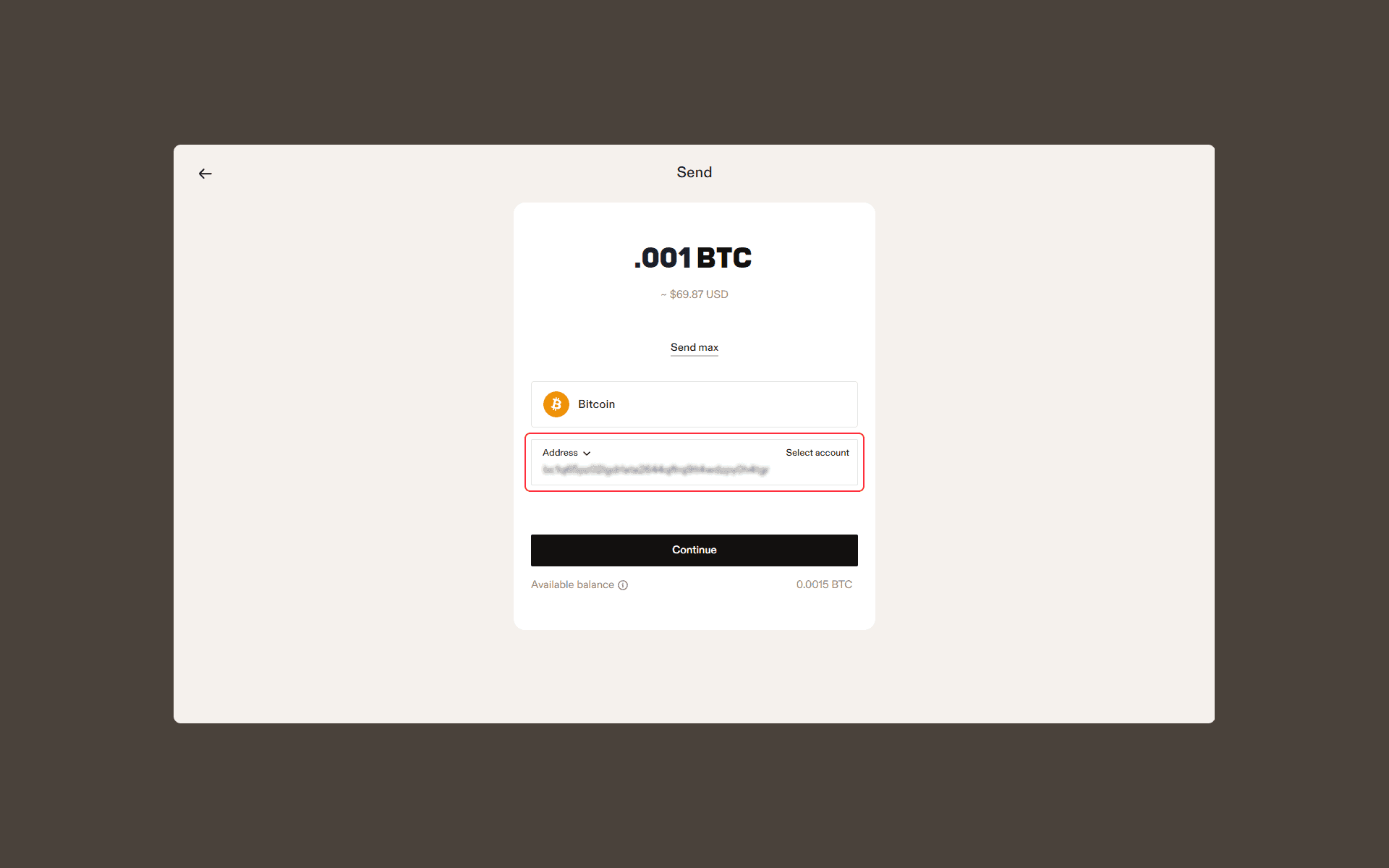

- To start, access Leather’s desktop extension and hit the ‘Send’ button in the upper-left corner.

- Next, choose which asset you’d like to transfer. If it’s BTC, you’ll enter the amount you want to send and the Bitcoin address for the recipient.

- Next, choose which type of Bitcoin transaction fees you’d like.

- Finally, complete the transaction. The crypto will be sent to the recipient’s unique wallet, regardless of their physical location. For more information, see the Leather guide to transferring Bitcoin.